Personal Leasing

Lease any vehicle under the sun

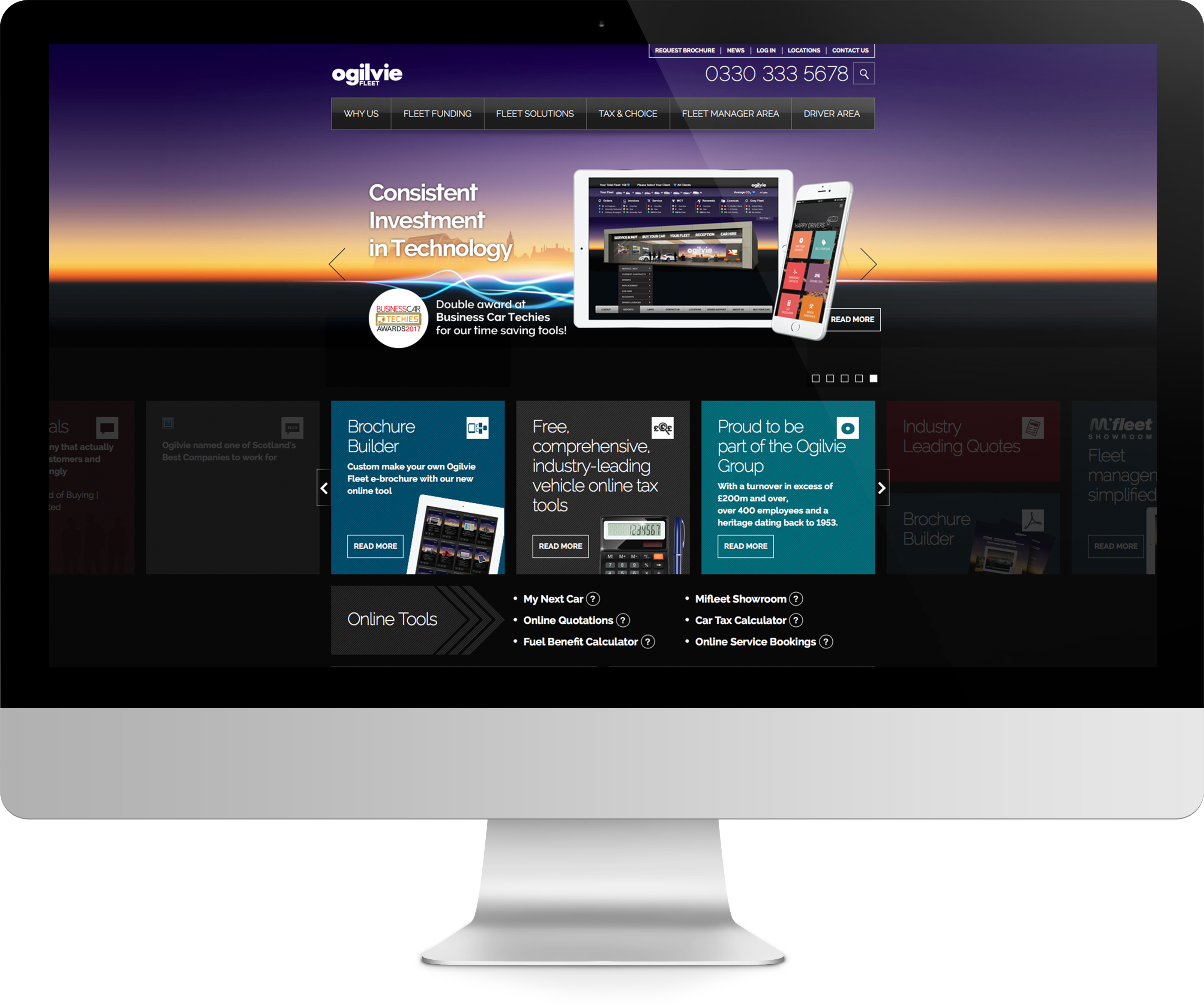

Partnered with

Ogilvie Fleet

A company car offers lots of positive benefits including:

There is not a “one size fits all” answer when it comes to deciding between a company car or company car allowance. As with most aspects of driving, this is a personal decision based on your individual circumstances such as your personal needs, financial situation and other tax liabilities. That is why it is important to research both options before making a decision either way.

If you have a question or would like more information please visit https://www.ogilvie-fleet.co.uk/